Flipping the Script Amid an Inverted Yield Curve

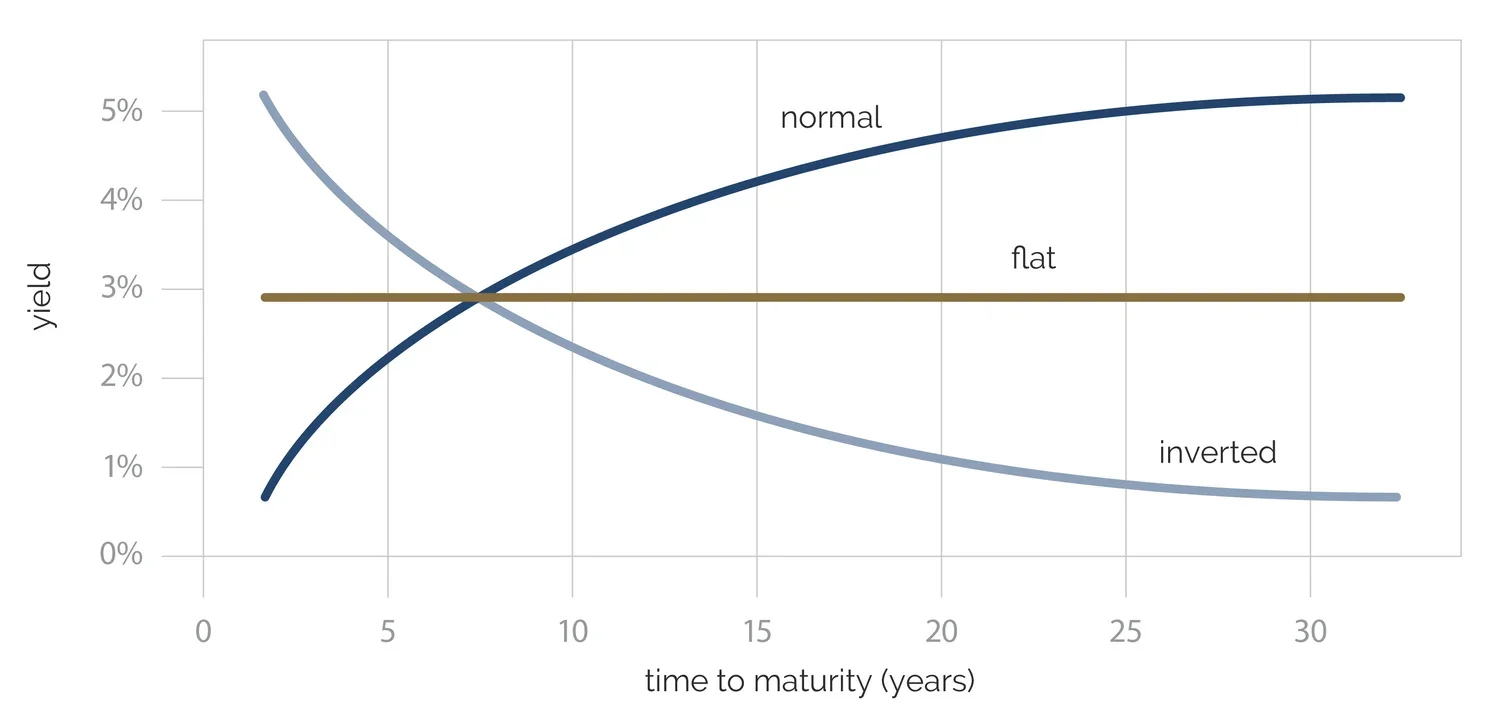

Every now and then — about 10% of the time, according to Encyclopedia Britannica historical data — the yield curve will invert or slope negative, indicating that short-term interest rates are higher than long-term rates.

Currently, and for much of the past year, the yield curve is inverted, with 3-month Treasury yields higher than 10-year Treasury yields. In fact, in early July, the yield curve reached its steepest inversion since 1981.

Unique Opportunity to Diversify with Muni Bonds of Varying Maturities

We’ve adapted to this uncommon scenario by investing capital in municipal bonds at both the short end (typically two years or less) and long end (10 years or more) of the maturity curve. This barbell approach seeks to take advantage of the market opportunity and to help advisors optimize clients’ municipal bond allocations.

When market dynamics shift and new opportunities arise, as they have over the past year, we believe shifting from a defensive portfolio management approach to an offensive approach is a game-winning strategy.